We serve leading international and national oil companies, oilfield-services and equipment providers, and private-equity investors across the entire oil and gas value chain. Our global team of consultants and experts helps our clients develop strategies to manage risk, optimize their organizations, and improve performance. We build capabilities to deliver lasting improvement

About this practice

What we do

We have regional leaders all over the world with a deep understanding of their local competitive and physical context, as well as an extensive global network of consultants, experts, and external advisors. We provide targeted support for clients in areas such as:

- National oil companies

We understand the strategic and operational challenges NOCs face in delivering high performance and advancing national development. We help them balance national and commercial objectives for success, grow internationally in an increasingly competitive environment, and attract and develop top talent.

- Risk

We help oil and gas players mitigate and manage commercial, operational, and political risk, and enhance their performance in enterprise risk management and risk-based investments. We have developed proprietary tools and frameworks to diagnose risk, design best-in-class risk management systems and processes, assess risk culture, evaluate risk oversight, identify cash flow at risk, and analyze opportunity cost.

- Oilfield services and equipment

We bring clients a deep understanding of competitive strategies, customer needs, and growth opportunities across the OFSE sector. We support oil and gas companies with technology strategy and procurement; advise services and equipment providers on strategy and operations; and counsel principal investors on strategy, commercial due diligence, and portfolio value creation.

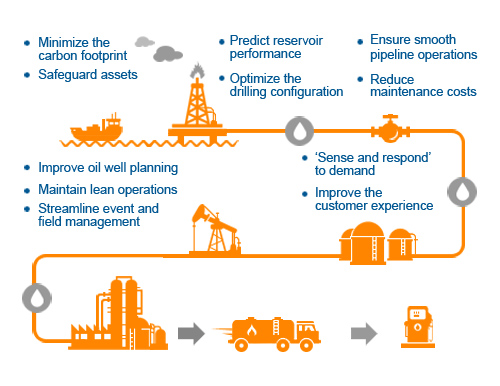

- Business technology

To help clients reduce exploration and production development costs and raise productivity in their upstream and downstream businesses, we offer state-of-the-art expertise in technology enablement (including digitization, big data, and advanced analytics), multichannel customer value management, and automation, asset utilization, and productivity management. We work with companies to optimize IT strategy and performance, create value from business and IT transformations, ensure the successful delivery of capital projects, and implement best practices in global business shared services.

Our expertise

Capital productivity

We help clients deliver world-class projects that yield maximum return on invested capital.

Oil and gas capital projects are becoming ever more complex. Venturing into unfamiliar terrain, extracting unconventional resources, managing intricate supply chains, and complying with rigorous environmental, health, and safety regulations all present huge challenges. Even the most successful companies routinely suffer cost and schedule overruns.

We help our clients achieve sustainable improvements in their project performance and capability development. We have advised some of the world’s top oil and gas companies on capital productivity, in projects spanning all major hydrocarbon basins.

We offer clients fresh insights, proven methods, and access to an unequalled pool of expertise, with specialists who are supported by experienced practitioners and dedicated implementation teams.

We support clients at every stage in their capital projects:

During planning, we help clients with developing a project concept to deliver the greatest value at the lowest risk, using design tools to drive project value, and applying a modular approach to reduce capital expenditure.

In contracting and procurement, we help clients define a contracting model, select contractors, and establish appropriate price structures, contract terms, and incentives.

During project execution, construction, drilling, commissioning, and ramp-up, we help and boost project management through schedule optimization, contractor management, and lean execution—including waste and performance loss elimination—at the yard, on-site, and offshore.

To enhance project governance, we help clients define an operating model covering all dimensions of capital expenditure, from technical processes to mindsets and behaviors.

Downstream

We support oil and gas companies with strategy development, asset utilization, and capability building to boost their performance in downstream operations.

Setting the right operating strategy is critical to achieving consistent profitability. We help clients assess downstream market fundamentals to identify strategic opportunities and build capabilities in advanced analytics and fact-based problem solving to boost their agility, confidence, and competitive edge.

At the same time, we help clients sustain top-quartile operational performance while adhering to sound operating principles and maintaining high health, safety, and environmental standards.

Our experience across all industries and regions gives us deep insight into what it takes to achieve operational excellence. We engineer organizations for success by addressing technical systems, management infrastructure, capabilities, and mindsets together in an integrated approach.

We have an extensive global network of downstream specialists who are supported by experts, analysts, and external advisors. To stay ahead, we invest in developing approaches, tools, and data sets across the downstream value chain, including refining capacity, crude and product supply and demand, and equilibrium pricing. To bring clients the best thinking, we develop global, regional, and functional perspectives and explore industry hot topics.

Organization

We help oil and gas clients engineer their organization for success through our unique combination of proven tools and techniques and inside industry knowledge.

The trends shaping the global oil and gas industry raise fundamental questions about how players improve their leadership development, enhance top-team effectiveness, think strategically about their workforce needs, close technical capability gaps, strengthen local talent pools, manage mega projects, and organize for safety and growth.

Transformation programs are often seen as the answer to these questions, yet their effects can be short-lived. Our approach, based on decades of client work and extensive in-house research, focuses on helping organizations improve their health as the means to sustaining excellent long-term performance. That involves building the right capabilities, embedding efficient processes, and constantly reviewing the opportunities they pursue.

By blending our breadth of organizational experience with deep inside knowledge of the oil and gas industry, we bring clients the best thinking on the most critical challenges they face. We also develop our own perspectives on hot topics such as growing through joint ventures and partnerships, adding value through nonoperator governance, organizing for unconventional gas, and weighing the merits of integration versus disaggregation.

We bring deep expertise to help clients address industry hot topics such as closing the technical talent gap through strategic workforce planning, meeting local content requirements and strengthening the local talent pool, designing organizations for mega projects, and improving the governance of operated-by-others activities.

We also offer unparalleled experience in tackling organizational challenges such as strengthening leadership development, changing mind-sets and behaviors, simplifying organization design, boosting the corporate center’s effectiveness and efficiency, designing performance-management systems, and managing events such as mergers, divestitures, and executive transitions.

Unconventionals

We help clients optimize their business to capture the potential of tight gas, shale gas, and light tight oil.

We help clients optimize their business to capture the potential of tight gas, shale gas, and light tight oil.

Unconventional developments have achieved enormous technical success, yet their economics remain challenging. Well productivity is declining as prime locations are drilled out and operators move to less productive basins. Drilling performance and costs vary widely within the same asset and even the same operator, revealing substantial scope for improvement.

In an environment where improving efficiency and reducing costs are paramount, some of the biggest opportunities we have identified lie in eliminating waste and variability in fracking, materials logistics, drilling, and rig mobility processes; integrating planning across the field to optimize materials management and resource use; and ensuring that information on well productivity flows to the people who need it.

We launch a new client project in onshore upstream unconventionals every three weeks. As trusted advisors to independents, majors, service companies, and investors, we have developed unrivalled industry knowledge.

Our investments in proprietary research, benchmarking, modeling, and capability building ensure we bring the best thinking to our clients, taking a full lifecycle value approach, including Health, Safety and Environmental (HSE) considerations.

We help operators capture the potential of tight gas, shale gas, and light tight oil through better insight into:

Operations excellence: reaching best-in-class performance in the speed, accuracy, and economics of drilling, completions, and field operations; optimizing surface equipment design for efficient, timely, and safe subsurface access and reservoir production; and building lean, agile organizations to thrive in a fast-growing industry.

Market outlook and strategic implications: understanding the outlook for supply, demand, and other macroeconomic factors; gaining insight into emerging market strategies; and developing a portfolio strategy by stage of development.

Midstream perspectives: evaluating supply and flow shifts in differentials and netbacks; understanding how they influence producers’ decisions; and assessing midstream requirements to optimize investment and ownership models throughout the life of lease.

Emerging-basin entry: developing country- and basin-specific strategies and innovative operating models for new regions such as China, Latin America, and Eastern Europe to take account of economics, access to preferred basins, and the competitive landscape.

Technology and equipment: finding the pain points in the value chain that trigger issues with costs, the environment, and the social license to operate, and identifying technological trends and innovations to take performance to the next level.